About Us

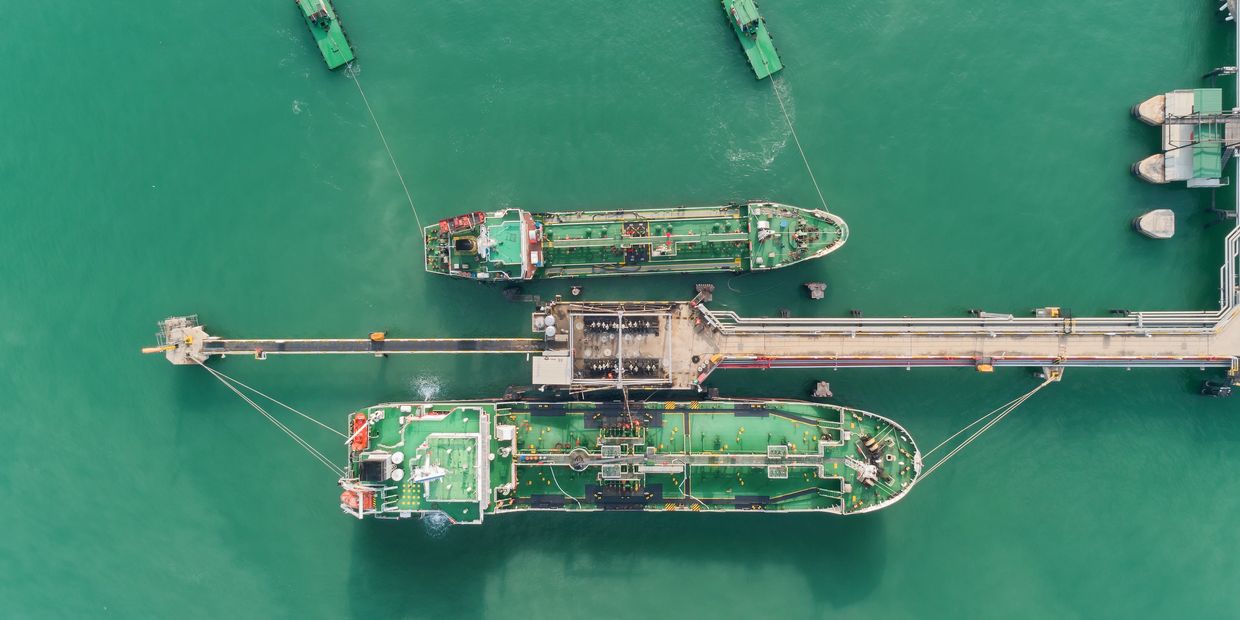

UNIQUE 20 YEAR LONG TERM FIRM ENERGY US DOLLAR INDEX PPA FOR THE FIRM ENERGY STARVED COLOMBIAN ENERY SECTOR AND EXCLUSIVE FSRU FOR NATURAL GAS SALES INTO THE COLOMBIA CONSTRAINED NATURAL GAS MARKET

Participate in the Upcoming Firm Energy Auction and secure a competitive position by leveraging on the following:

The ONLY Viable “20-YEAR LONG TERM FIRM ENERGY BID COMPLIANT” LNG to POWER Project in Colombia.

1.The 2,240 MW Termoinduenergy-Nencol 5 power project is registered under UPME Phase 2. (13% of the Colombian Energy Sector) 2.The existing deed water Sociedad Portuaria de las Americas Port 3.The existing Induenergy Industrial Park ( 75 acres) with the approved Land Zoning for Building Power plants ●

And secure the following:

1.20-Year US Dollar Indexed Firm Energy Payment and under this guaranteed US Dollar payment, develop and finance the 2,240 MW power plant and 2.Under the 20-Year Long Term Firm Energy Payment embed and include the cost for the FSRU Lease or acquisition of the 170,000 MT storage capacity and 400,000 MCFD regasification capacity FSRU.

TERMOINDUENERGY-NENCOL 5

Setting up a 2,240 MW natural gas-fired power plant in Colombia can offer several benefits, particularly given the country's current energy landscape. Here's a detailed breakdown:

Benefits of a Natural Gas-Fired Power Plant

Diversification of Energy Matrix: Colombia is heavily reliant on hydroelectric power, which accounts for a significant portion of its electricity generation. By introducing a large natural gas-fired power plant, the country can diversify its energy matrix, reducing dependence on a single source of power. This diversification can enhance energy security and reduce vulnerability to fluctuations in hydroelectric output.

Reliability and Consistency: Hydroelectric power generation in Colombia is susceptible to variations in rainfall and climate change, leading to periodic shortages and brownouts every 5 to 6 years. A natural gas-fired power plant can provide a reliable and consistent source of electricity, mitigating the impact of droughts and ensuring a stable power supply to meet demand.

Reduction in Market Volatility: The current reliance on hydroelectric power leads to significant market volatility, affecting energy costs for consumers. By adding a substantial amount of thermal generation capacity, the energy market can become more stable. Natural gas-fired plants can offer a more predictable cost structure compared to hydroelectric plants, whose output and costs can vary widely due to climatic conditions.

Lower Energy Costs for Consumers: With a more diversified and stable energy mix, Colombia can potentially reduce the high energy costs that consumers face during periods of hydroelectric shortage. Natural gas-fired power plants can provide electricity at a more stable and possibly lower cost compared to alternative backup power sources that might be used during droughts.

Economic Benefits: The construction and operation of a large natural gas-fired power plant can stimulate economic activity, create jobs, and attract investments. This can have a positive impact on local communities and contribute to national economic growth.

Environmental Benefits Compared to Other Fossil Fuels: Natural gas is considered a cleaner fuel compared to coal or oil, producing fewer emissions per unit of electricity generated. A natural gas-fired power plant would emit less CO2, SO2, and NOx compared to other fossil fuel-based power plants, making it a relatively cleaner option for thermal power generation.

Quick Response to Demand: Natural gas-fired power plants can ramp up and down quickly in response to changes in electricity demand, making them highly complementary to renewable energy sources like hydroelectric power. This flexibility is crucial for balancing the grid and ensuring that supply meets demand at all times.

Addressing Constraints

Gas Supply Infrastructure: One of the primary constraints for setting up a natural gas-fired power plant is ensuring a reliable and adequate supply of natural gas. Colombia would need to assess its natural gas reserves, production capacity, and transportation infrastructure to support the power plant's requirements.

Regulatory Framework: The Colombian government would need to ensure that the regulatory framework supports the development of natural gas-fired generation. This includes policies related to gas pricing, power purchase agreements, and grid access.

Environmental and Social Impact Assessments: Careful consideration must be given to the environmental and social impacts of both the gas supply chain and the power plant itself. This includes assessing water usage, emissions, and potential effects on local communities.

Integration with Existing Grid: The power plant's output needs to be integrated into the existing grid infrastructure. This might require upgrades to transmission lines and grid management systems to ensure that the power can be efficiently distributed across the country.

Market Design and Incentives: To encourage investment in natural gas-fired power plants, appropriate market mechanisms and incentives might need to be put in place. This could include capacity payments, long-term contracts, or other financial incentives to ensure the economic viability of such projects.

In conclusion, a 2,240 MW natural gas-fired power plant in Colombia can significantly enhance the country's energy security, reduce market volatility, and provide a more stable and potentially lower-cost source of electricity for consumers. However, addressing the constraints related to gas supply, regulatory frameworks, environmental impacts, and grid integration will be crucial for the successful implementation of such a project.

NATURAL GAS SALES USING THE DEDICATED TERMOINDUERNGY-NENCOL FSRU

Having an installed Floating Storage Regasification Unit (FSRU) in Colombia can offer significant financial benefits, particularly when the capital expenditure (CAPEX) is assumed under the firm energy payment mechanism. Here's a detailed breakdown of the benefits:

Financial Benefits

Reduced Upfront Costs: By having the CAPEX for the FSRU assumed under the firm energy payment mechanism, the financial burden on the natural gas supplier or buyer is significantly reduced. This allows for more efficient allocation of capital and reduces the upfront costs associated with developing an LNG import terminal.

Predictable Revenue Stream: The firm energy payment mechanism provides a predictable revenue stream for the FSRU owner, as they receive payments for providing reliable regasification capacity to the grid. This stability can attract investors and reduce financing costs.

Competitive LNG Import Costs: With the owner of the natural gas supply bringing LNG into Colombia at competitive rates, the cost of importing natural gas can be minimized. This can lead to lower gas prices for power generators and other consumers, making natural gas a more competitive fuel source.

Regasified Natural Gas Sales: The owner of the natural gas supply can sell regasified natural gas into the Colombian market at competitive prices, generating revenue without having to assume the financial costs of purchasing or leasing the FSRU. This can lead to higher profit margins for the natural gas supplier.

Increased Energy Security: The FSRU provides a reliable source of natural gas, enhancing energy security in Colombia. This can reduce the country's dependence on hydroelectric power and mitigate the impact of droughts or other disruptions to the energy supply.

Flexibility and Scalability: FSRUs offer flexibility and scalability, allowing for adjustments to be made in response to changes in natural gas demand. This can help to optimize the use of the FSRU and reduce costs associated with underutilization.

Benefits for the Natural Gas Supplier

No FSRU Ownership or Leasing Costs: By not having to assume the financial costs of purchasing or leasing the FSRU, the natural gas supplier can focus on importing LNG and selling regasified natural gas into the Colombian market without significant upfront costs.

Competitive Market Position: With access to a reliable and competitively priced source of natural gas, the supplier can strengthen its market position and increase its competitiveness in the Colombian market.

Increased Profit Margins: By selling regasified natural gas at competitive prices, the supplier can generate higher profit margins and increase its revenue.

Benefits for Colombia

Diversified Energy Mix: The FSRU can help to diversify Colombia's energy mix, reducing dependence on hydroelectric power and increasing the use of natural gas for power generation.

Enhanced Energy Security: The reliable supply of natural gas can enhance energy security in Colombia, reducing the impact of droughts or other disruptions to the energy supply.

Economic Benefits: The development and operation of the FSRU can create jobs, stimulate economic activity, and attract investments, contributing to Colombia's economic growth.

Key Considerations

Regulatory Framework: A stable and predictable regulatory framework is essential for attracting investments in FSRU infrastructure. The Colombian government needs to ensure that the regulatory environment supports the development and operation of FSRUs.

Contractual Agreements: Clear and comprehensive contractual agreements between the FSRU owner, the natural gas supplier, and the Colombian government are crucial for ensuring the financial benefits of the project are realized.

Market Demand: The demand for natural gas in Colombia needs to be sufficient to justify the investment in FSRU infrastructure. The development of the FSRU should be aligned with the country's energy policy and demand projections.

In summary, having an installed FSRU in Colombia with CAPEX assumed under the firm energy payment mechanism can offer significant financial benefits to all parties involved. The predictable revenue stream, competitive LNG import costs, and increased energy security can make this project an attractive investment opportunity. However, a stable regulatory framework, clear contractual agreements, and sufficient market demand are essential for realizing these benefits

Instagram

Reviews

NODO ENERGETICO DEL NORTE DE COLOMBIA S.A. ESP

PBX:1 (281) 445-7500 DIRECT: 1 (281) 814-3630

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.